Officially, we are NOT in a recession…Yet.

But based on how fast things have been moving during the last few weeks, there is no time to “wait and see” what happens to the economy.

You need a Covid Crisis Cash Plan TODAY.

Getting through any crisis requires you to “Model, Imagine, and Act” to preserve the cash flow of the company. Here’s what you should be doing NOW.

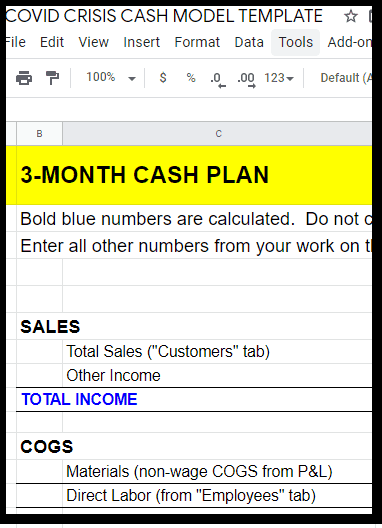

In times like these, a simple XL model is your best friend. I’ve not yet met any accounting software that can do a decent job of projecting the future, but you can — with a simple cash plan model in XL. I’ve built the template for you (XL Template, or Google Sheets Template) and you can modify it in about 20 minutes. Here’s how:

Once you have these fundamentals, you can begin projecting the future. The template is set up for 3 prior months and 3 future months, but you could copy entire columns to make it as large as you need.

Start with the “Sales” tab. Do you believe that the COVID crisis will reduce your sales? Perhaps, as in my case, each of your customers is a bit different. I have clients in the restaurant industry that are likely to close up shop. Others, in healthcare, might actually need more help in the coming weeks.

Guess at the income you’ll receive from each customer in the coming 3 months (or more if you’re brave). And remember — this is cash basis. So if a client has been slow to pay in the past, you may want to project even slower payments in the future.

Now switch to the “Employees” tab and swallow hard. If sales decline in the way you’ve modeled, do you need all your current employees? Cut a few heads and see what happens.

On the “P&L” tab, your job is to strip out any expenses you don’t need. Extra software licenses? Slash-em. Paying for a co-working space you don’t use? Cancel it. Cleaning services? Water delivery? Cut cut cut. Project the expenses over the next 3 months or more and tally it up. When you’re done, you really only need two numbers from this page: non-payroll cost of goods, and non-payroll overhead. (Remember, you dealt with payroll above)

Put it all together on the “Cash Plan” tab. A lot of the cells will already have information in them because I built it to do that for you. But others need your input. Copy the non-payroll expenses you just calculated into the right rows.

And finally, put your bank account balance at the space near the bottom.

Cells with bold blue type are calculated for you.

When it’s done, you need to focus on available cash — the bank account balances projected into the future.

Have you cut enough expenses to survive?

Play around some more with different scenarios — showing more clients leaving (or not). See how things might go.

With a good plan in place, don’t hesitate to implement. The worst part about economic slowdowns is that you don’t see them until it’s too late. This one is different. It is here. Now. People are not eating out, going to movies, flying to vacations, shopping, or even driving. The change has been earthshaking, and the more dangerous aftershocks are on the way.

Start making calls to trim your overhead. Can you sublease some space? Can you live without delivered water? You modeled the reductions — make it happen.

Finally, separate your staffing reduction plan into phases — cutting too soon could endanger work that’s on your desk now. (But cutting too late is worse.) Decide now what the triggers are. Then stick to them.

“Stay Safe” seems to be the new touch-stone for the Coronavirus age. It applies to a company’s economic health as well as you physical health. Be conservative, act rationally but quickly. Stockpile cash. Keep selling.

I hope this model is helpful, and invite you to call or email me with any questions or challenges.

Stay safe — and we’ll see you on the other side of this crazy time.

-David

© 2018-2025 Fuse Financial CFO & Accounting, LLC. All rights reserved.