The ABC reality TV show “Shark Tank” is incredible. Each week, contestants are offered millions of dollars for a piece of their company. They have about 30 seconds to say yes or no. It looks simple, doesn’t it?

Behind the scenes, it is anything but simple — and the business owners are the most likely to be the least prepared. I suppose that’s why this is called the Shark Tank. A lot of these business owners get eaten alive and end up selling their company for far less than it is worth.

Imagine you are in front of the Sharks on ABC’s “Shark Tank” show. They ask you point blank, “What’s your company worth today?” Do you really know the answer? Would you know what THEY think its worth by how much they offered you? You should… and you can, if you have a cap table.

Put yourself in Chris’ shoes. Chris started a cool new dot-com business. Then Chris invited two friends to join in: Tracey and Pat. They contributed a bit of money and he gave them a bit of stock. So far, the story looks like this:

Now one of the Sharks wants to buy 20% of the company. Great! There’s just a few questions: How many shares should we give him? How much should he invest? If he pays $10 per share, what’s the company worth? And how much of the company does Chris (the founder) still own?

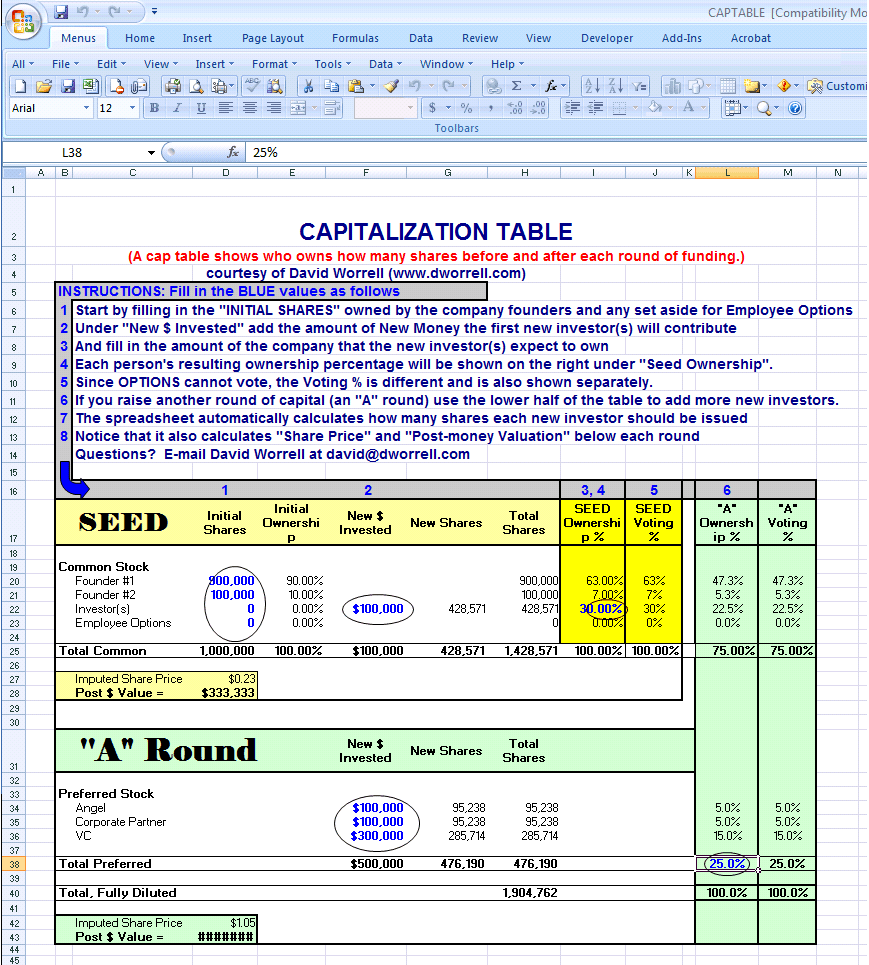

Here’s an example of a cap table I made in Excel (click the image to buy it, or read on to build your own.)

Here’s an example of a cap table I made in Excel (click the image to buy it, or read on to build your own.)Today’s angel investors ask these questions — and many that are much harder — and expect exact answers from you.

Here’s 8 things that Angel Investors (sharks!) expect YOU to know about your business and the offer you are making:

These are the kinds of key questions that only a capitalization table can answer. You need to know the answers, or your investors will simply say “I’m Out!”

Fortunately, a good Capitalization Table, or “Cap Table” can make this simple.

Look. You have a business. You have investors. Your financial future, your job, and your company are all on the line. You need a cap table. No investor is going to give you real money without one, and no business owner should ever take anyone’s money without understanding how it impacts everyone else’s current ownership.

How to Make a Cap Table Yourself

To make your own cap table, start simple. You can quickly calculate your stock value, ownership, and more in 6 simple steps:

That’s it! You’ve just created a basic cap table that describes your company’s current ownership structure. From this you can answer the basic questions “Who owns the business?” and “How much is it worth today?”

Cap tables are spreadsheets, so they can become much more complex. You can build a bigger model, like the one in the illustration, to project the changes in ownership as new investors come in. And if different investors get different voting rights, then you could create a column to include that calculation as well.

The basic capitalization table, however, is simple enough that every entrepreneur should take a moment to make one. Even if you’re not headed for a reality TV show, you never know when you’ll run into a shark! (Ready to buy a cap table that’s ready to go?)

Your Virtual CFO, David Worrell

photo credit: alfonsator via photopin cc

8326 Pineville Matthews Rd #407

Box #473831

Charlotte, NC 28226

Phone: (980) 819-0510

© 2018-2024 Fuse Financial Partners LLC. All rights reserved.