Getting through the Next Business Crisis: Will You Be Ready?

Making it Through the NEXT Business Crisis

Wouldn’t it be nice if your enterprise could stand the test of time and rise to become an iconic brand — instantly recognizable for its steadfast presence over decades?

Wouldn’t it be nice if your enterprise could stand the test of time and rise to become an iconic brand — instantly recognizable for its steadfast presence over decades?

Sure, it’d be nice, but it is statistically unlikely. In the 1950s a business could be expected to last about 60 years, a recent study found that today’s luckiest companies make it only to the 20-year mark. And of course we’ve seen so many companies lose the battle during the COVID era.

So what drives longevity? Let’s take a look at a few key considerations that can help you get to the 20-year mark… and beyond. These steps won’t make you invincible, but they can put you in a better position to respond, recover, and — ultimately — thrive.

Engage in Planning

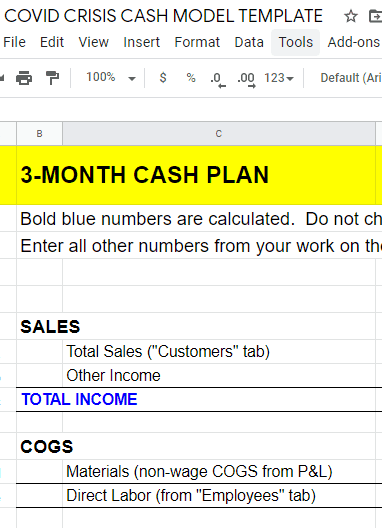

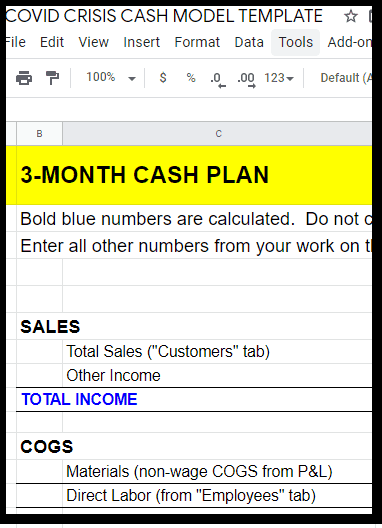

Planning is an essential aspect of any business’s financial stability. This doesn’t just mean having a static business plan in place. It will take agile preparation to meet the unexpected and recover.

Being truly “Engaged” in planning should include:

- Monthly Financial Statement Reviews

Your financial statements (P&L, Balance Sheet, Statement of Cash Flows) are not just useful to tell you the current financial state of your business: they can also be instrumental in helping you understand the trends and future direction of your business. Using financial statements regularly means charting what has changes, and digging deep to understand what’s working and what is not.

Want a secret tip? Get a CFO or CPA to review your balance sheet regularly. The balance sheet holds the key to good bookkeeping, and knowing how to “read” the balance sheet will elevate your understanding of your business.

- Spending: Visibility and Controls

Even highly profitable companies need to keep spending under control (and to build savings for resilience).

Having up to date books in software that is accessible to the leadership team in real time is an important first step.

Reviewing expenses in real time allows you to see where controls are needed before its too late. Seek to collect expense receipts and supplier invoices as early as possible so that these can be included in real-time reports.

Invest in the Intangible

A solid financial underpinning that influences longevity is not just focused on cash. Remember that some of the most valuable assets in your business are intangible. Use and nurture them in ways that will help your business recover from a disaster.

This should include:

- Talent Development

Your employees’ talents and abilities will make or break your business, particularly when other things are not going well. Investing in your human capital boosts their economic value to your company on a day-to-day basis, and during hard times. Prioritize education and training to increase productivity and innovation.

But there’s more that makes your people resiliant — the relationships and bonds they build throughout the company can breed loyalty and commitment. Creating paths for career progress demonstrates that your business cares about employees, reduces turnover and attracts more valuable talent. The stronger your talent development, the stronger your business will be in the long term.

- Brand Value

Your brand can be one of the most important intangible assets you have when times get tough. This goes beyond a good name and a great logo — although those things can certainly help. For your brand to help you through periods of uncertainty, you need to ensure that it is a byword for professionalism, trust, and expertise with the public, employees, and the industry alike.

Utilize marketing channels to make authentic connections with stakeholders and build your profile. Keep brand development as a key factor throughout projects, changes, and planning.

Having Backups

In a commercial environment that so often sees businesses fail, it is likely that your business is going to come up against unexpected challenges. While you should be preparing to prevent the worst from disrupting operations at all, it is vital to have backup resources to help carry the load of a disaster. These can ensure that you have the financial assets to cushion the blow and allow your business to move swiftly from survival into recovery.

These backups should include:

- Insurance

Every business should have the basics covered with physical (fire / hazard) and professional (liability) insurance. But knowing how much to hold and when to change is important. Review your business insurance coverages regularly,

Property and contents insurance might cover the physical assets, but business interruption insurance accounts for the other losses you might incur due to the inability to operate. Review the potential for disruption, and insure accordingly.

- Credit

The COVID pandemic demonstrated just how much financial difficulty businesses can get into when their income stream is disrupted unexpectedly. While this kind of issue is rare in the grand scheme of things, it can still be wise to access financing that will help you get through the most challenging months until you regain your stability.

It’s wise to consider a blended form of emergency funding that stems from different sources — small loans, investors, emergency savings, supplier credit. Review what approach is most suitable for your business’s circumstances, and where possible make arrangements in advance.

Conclusion

Longevity in business is not to be taken for granted. It takes work to increase your resilience, and that starts with putting financial strategies in place. Frequently engage in agile planning, develop your intangible assets, and put robust emergency financial cushions in place. There’s never any guarantee to avoid disaster, but you can improve your response.

With a degree in entrepreneurship, Sam has built his freelance writing business in both print and digital media. Sam knows the “hustle” mentality and has seen the world roll through turmoil, successes, elections and generation changes. He chronicles these changes in the business sector through research and education.